January 19, 2016

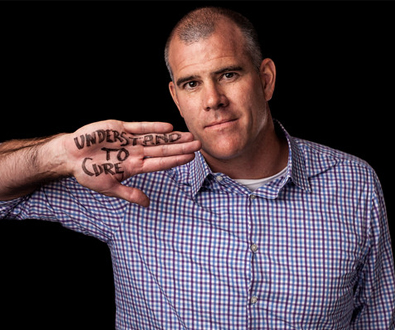

While 2015 was a remarkable year for genomics globally, growth in the Americas region was particularly notable. Mark Van Oene discusses standout moments from last year and insights for the year ahead.

What drove success in the Americas in 2015?

Growth in the Americas was very strong throughout 2015 as we delivered 28 percent shipment growth through the first three quarters of 2015. You can imagine there is a lot of really exciting work being done. Whole genome sequencing (WGS) and the amount of elasticity of that application is a huge contributor to Illumina’s growth in general and our success in the U.S. in particular. Many of our HiSeq X customers are running at high utilization rates, and/or are continuing to add capacity to their original HiSeq X deployment.

Clinical customers are also driving growth – primarily attributable to our non-invasive prenatal test (NIPT), as well as the clinical laboratory developed test (LDT) business, which is growing very rapidly and has contributed to a lot of our success in expanding our clinical customer base in the Americas.

Progress in oncology has also been impressive, particularly with how molecular tumor boards are beginning to apply next-generation sequencing (NGS). These boards are working groups comprised of oncologists, geneticists, pathologists and bioinformaticians exploring new options for cancer treatment.

Additionally, new and emerging applications of NGS have started to flourish, for example by expanding into food testing facilities and through public health deployment. This includes government agency utilization for surveillance, as well as some microbiology and infectious disease testing. It has been really interesting to support our customers in their development of these markets.

Geographically speaking, in Canada, they are investing to ‘repatriate’ whole genome sequencing. This has led to significant infrastructure investments happening in Canada. The clinical markets and the regulatory environment around LDTs in Canada are also enabling comparatively rapid growth there. Look for NIPT, public health and many more clinical applications to continue to grow.

In Latin America, currency and political challenges have impacted the market similarly to what we’ve seen in other international markets. That said, Brazil leads the business in that region. We’re also seeing business pick up with our new channel partner in Mexico. We have great growth expectations for Mexico, Brazil, Chile, Columbia and Argentina over the next two years.

You work on the frontline with our customers. What are you hearing from them?

I hear we’ve done a really good job building up the ecosystem around our sequencers. In prior years, the emphasis was around the sequencing technology and our ability to generate lots of bases. But more and more now, the conversations involve the use of informatics, whether that’s our BaseSpace or NextBio platforms – which are used to explore applications enabled by our library prep chemistries and panel offerings. Creating the ecosystem around the sequencer makes it much easier to work with Illumina as a single vendor and for us to properly address customers’ application-specific needs.

We’ve also invested in people to provide support for the entire workflow. Our field support and service teams have the library prep and informatics expertise required. They are capable of handling the entire workflow of training and trouble-shooting for our customers. And that’s really important, especially for customers new to NGS. Making the entire workflow easier for our customers has been critical to our NGS adoption.

And the array market?

I’m really encouraged. Traditionally, the direct-to-consumer (DTC) market has driven array growth in the Americas. With DTC customers continuing to grow and expand their footprint, I’m going to expect high array growth rates since these markets are predominantly array applications right now.

That said, I think Helix will also bring consumer markets into the realm of sequencing and enable new companies to market tests to the masses. It’s an exciting spin-off of the organization and something I’m excited to see develop over the next couple of years.

Regarding arrays overall, I’m seeing a big need for a low-cost array to be used for millions of samples. At a recent event, we spoke about the potential for a global screening array, where we ambitiously said we hoped to bring together a consortium for 3 million samples. There’s a real need and excitement about what we could do with the screening array approach for millions of samples at a lower price point than what is currently available to the market.

The agrigenomics market is also well poised for array growth. There is huge opportunity for different types of livestock, companion animal and crop screening applications. With that in mind, within my world, Brazil, Columbia and Argentina present some of my biggest near-term agrigenomics opportunities. As a whole, these are great stories because they’re about feeding people and driving our vision [to improve human health by unlocking the genome].

What are you excited about in the near term?

The NIPT market in the U.S. is going to continue to expand. Success there is not only about great growth, it’s also about being truly disruptive and offering better options for women’s health and for babies.

Overall, we have great NIPT customers in the Americas. We have grown so quickly and have been building teams around customers not just for selling and marketing, but also for services and support.

How do you plan to continue to support growth?

My role didn’t exist prior to 2014. Previously, I was VP of Global Sales. When we restructured in 2014, we created Regional General Management in the Americas so that there was a person accountable for not just the revenue, but also for the support aspects of our customer interactions. That’s given me the ability to more quickly make decisions, improve our escalation and communication processes, and allocate inventory or resolve other issues right away as needed by our customers.

We also realigned our service and support team with the sales organization, for better geographical alignment between those different functions. I’ve added over 120 people to the Americas organization in the last 18 months, with the flexibility to make those investments into the areas of greatest need. We’ve been really lucky to have support from the executive team for what we’ve needed to scale and to meet the demands of our growth.